Our Community Has Screened 1000s Of Publicly Listed Companies And Created A List Of 58 Of The Most Wonderful Stocks In The World. We Track The Valuation Of These Companies And Alert Members When They Are Undervalued.

Simplify Your Path To Wealth With Us – Where Investing Is Made Easy. Experience The Clarity Of Straightforward Financial Growth, Because Investing Should Not Be Complicated.

Because Contrary To What Pundits Preach, Investing Should Not Be Complicated

All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.

Warren Buffet

Price is what you pay, value is what you get.

Warren Buffet

We focus on rare long term high compounders. We wait patiently for stock prices to fall into our comfort zone, then buy aggressively and hold for the long term.

Li Lu

You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right

Benjamin Graham

Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time

Charlie Munger

Investors should look to buy a small number of high quality, resilient, global, growth companies that are of good value and which can be held for a long time

Terry Smith

All there is to investing is picking good stocks at good times and staying with them as long as they remain good companies.

Warren Buffet

Price is what you pay, value is what you get.

Warren Buffet

We focus on rare long term high compounders. We wait patiently for stock prices to fall into our comfort zone, then buy aggressively and hold for the long term

Li Lu

You are neither right nor wrong because the crowd disagrees with you. You are right because your data and reasoning are right

Benjamin Graham

Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time

Charlie Munger

Investors should look to buy a small number of high quality, resilient, global, growth companies that are of good value and which can be held for a long time.

Terry Smith

Unless you are interested in complicated investments, you don’t have to be an expert on financial jargon or able to analyze financial results into the finest details. The bottom line as warren buffet alluded to, is to buy shares of great companies at discounted prices and hold them for the long term.

So how do you know when companies’ stocks are trading at discounted prices? in his book, what works on wall street, james o’shaughnessy indicates that the price/sales ratio has been one of the most successful stock valuation methods over the years.

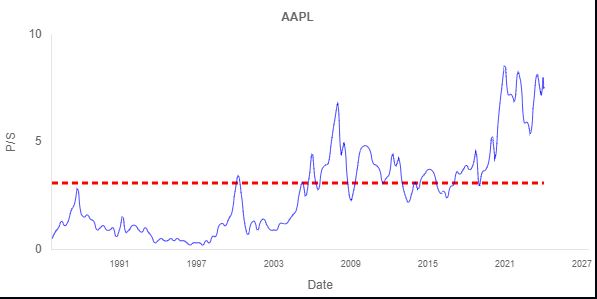

Price is the market capitalization for the company. For instance, the market capitalization for Apple was almost $3 trillion in November 2023.

Sales is the company’s total sales over the last 12 months. For instance, Apple had trailing 12 month sales of about $383 billion..

So, Apple’s price/sales ratio is $3 trillion divided by $383 billion = 8.

The price/sales ratio is one of the easiest methods to use for determining if a stock is undervalued. I typically review charts of the historical price/sales ratios of stocks that I follow to see if any of their latest ratios have dipped below their historical averages. For instance, in the chart, when the P/S ratio of a stock dips below the red dotted line (historical average P/S), it may indicate that the stock price is undervalued.

If the ratio is below the average, I try to determine if there’s a reason why. For instance, has anything major changed with the company or its business model that will affect the share price in the longer term? This may include one of the following:

- Changes in the competitive landscape.

- Company took on too much debt.

- Acquisition is not working out.

- Business model is no longer sustainable.

- Changes in the regulatory environment.

After researching the company and not finding anything that makes me think that it may affect the company over the long term, I initiate a position and hold it for the long term.

To make is as easy as possible to keep track of the price-sales ratios for the stocks that we follow, I created this website that shows the ratio charts for some of the world’s best companies all on one page. When the ratio dips below the historical average, community members are alerted and research on the company is shared via email.